How much your family's fund should grow? Do you know?

Cool, I want to start putting some money in a family fund but how can I know how much do I need to invest into it?. There is no general answer and it will depend on how much money you ear, how much money can you save and specially how much money do you need to afford your lifestyle.

In my previous post (check it here) I mentioned that if we want to build a pension for our children we only need to invest an amount of money when they born and let it grow over the years. I also mentioned that I prefer to actively invest money into the fund so it grows even more... But the example I gave was the "regular" example most of the people use to calculate a pension for someone who lives in the United States, what about those that don't? how do I know if that amount is enough? could be lower? Let's figure out.

How much does my lifestyle cost me every month?

First thing you should calculate is the amount of money you need each month to survive. To do this take a piece of paper and write every expense you do during the month, from the tip you give to the delivery guy up to the rent you pay (which is probably your biggest expense).

After you have this number, compare it to the amount of money you spent the month before, if you track all of your expenses this shouldn't be a problem... And if you aren't tracking then what are you waiting for?

After you have compared them you should try to separate your needs and take that number but to be honest at this point it doesn't really matter because this initial number will change multiple times so let's keep it simple for now. The idea is that you should constantly track your expenses and knowing exactly how much do you need each month.

I know how much I need each month... now what?

As soon as you know how much money you need we can start running the numbers. For example, imagine that you live in a mid range city in Colombia and you need USD$ 500 to live each month (I choose Colombia so you can compare this number with the ones I said in my last post).

These USD$ 500 will be enough to pay the rent, food, services and a couple of useless expenses... How do we calculate the amount we need? Well, it depends but to keep it simple let's imagine our fund is giving us a 5% of it's value in dividends each year.

If we need USD$ 500 each month, it means we need USD$ 6000 per year so if we want to know how much do we need invested we can do a simple math: (100 * (500 * 12)) / 5 = 120000... And we have found that to earn USD$ 6000 from our fund ever year we will need USD$ 120,000 invested.

Wait... Don't forget that lovely government wants his cut too.

Because we are earning money from our fund, we need to pay taxes and that means we actually need more money invested (and we will pay more taxes too but well... taxes).

Let's assume you will pay 20% in taxes (I have no idea how much taxes you pay in Colombia so I picked 20% since it's a common tax in many places). Now let's update our formula to include it: (100 * ((500 * 12)/(1-0.20))) / 5 = 150000. Now we know that we actually need USD$ 150,000 invested, from this we are going to earn USD$ 7,500 each year and we are going to pay 20% of it in taxes (which is USD$ 1,500). After paying our taxes we are going to have our expected USD$ 6,000.

There are ways to optimize this and pay less taxes with offshore business/foundations but it's expensive and it's easier to just move to a tax heaven instead.

Let's calculate how much should we invest to reach our goal

We already know the amount we need invested in our fund to afford our lifestyle, now we are going to calculate how much do we need to invest each month to reach that goal.

Your child's pension

If we only want to invest to build a pension for our kid, we should invest it as soon as possible (even better if you start before the birth date) so we have a long period of time earning a compound interest. How much will your child need in 65 years? well if you currently need USD$ 500 to live, let's say USD$ 1,811 will be enough (this is the a mount of inflation at 2% per year in 65 years).

Let's run the numbers: (100 * (1811 * 12/(1-0.20))) / 5 = 543300. So from this fund of USD$ 543,300 invested, your child will receive a 5% every year and that's USD$ 27,165 and will pay 20% in taxes (USD$ 5,433). At the end a total of USD$ 21,732 will be in his hands each year (which is USD$ 1,811 to spend each month).

Ok, now that we know how much it's needed, how can we reach that amount of money? We have two ways: Single or Multiple investments (To be honest, there are more but basically all can be separate in these two categories). Let's see both ways and we will be using a 7% of grow per year like in my last post.

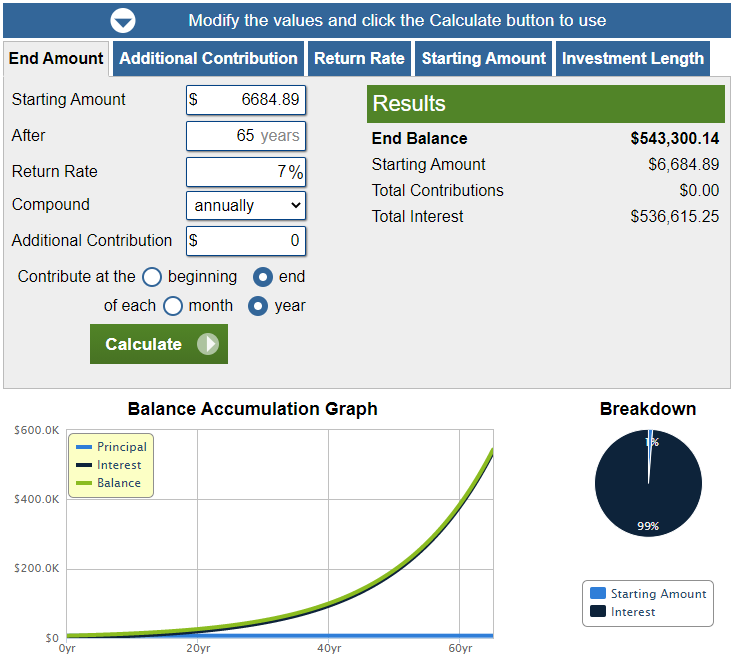

- Single investment: This method is a single investment we do when our child is born and we will let the investment grow over 65 years without touching it. To reach the USD$ 543,300 we will need to invest USD$ 6,684.89.

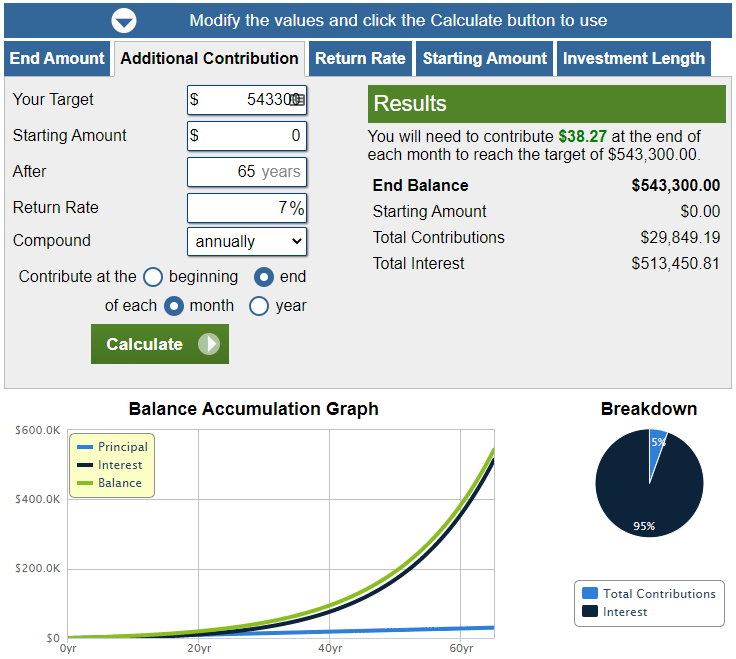

- Multiple investment: This method means we will be investing money during a period of time, if we start when our child is born and we stop after 65 years... we will need to invest each month the little amount of USD$ 38.27

Is that easy?

Believe it or not... It's that easy. Some people will say that we don't actually need that amount because we can just liquidate our funds and live from that. And yes that's true, if we do that we will need an smaller fund but to me that's not the point of a family fund. The idea of building this fund is to build something that it last for generations, if we start liquidating the funds then we are destroying that future (plus we will need to pay taxes when we liquidate the funds).

I hope this helps in your journey, we will go deeper into this subject in future posts because we still need to learn how to earn that 7% annually, how to avoid taxes in your fund, how to protect it against others and more. Take care.