Build the pension for your children before they born

Saving enough money for the moment we can't work anymore is not an easy task, many people rely on governments, the help from others or even have many kids so they take care of them when they are old... But, what if I tell you that you can build a pension for your children before they born with an easy plan, would you believe me? Spoiler: you should.

If you're reading this is probably that no one in your family did this for you and that's ok, nobody did it for me either but hey! It's never too late to start a new goal right?

But why not just using the government's pension?

Well, if you want a short answer I will say: Because you should not trust your government... But I'm not here to throw bad stuff about the government (or at least not in this article) so let me explain you why relying in the government maybe is not a secure bet.

Our government can go to a war

Let's jump into the first issue we could face: Instability. Governments are famous for one thing, they fight each others. So if we want to rely on them then we also need to know that there is the possibility our country starts a fight we can't win (somebody said Vietnam?) and as a consequence our pension is affected too.

Our government can destroy our country

Another reasons our country could go south is the changes between rulers, presidents always make changes but that doesn't mean all of them will be in the correct direction. Let's take the example of Venezuela (from where I am), it was one of the most advanced countries in Latin America where people could live and live without too much issues...

But then in 1998, Chavez won the presidency and so the disaster started. The country went from the Latin American dream to the most dangerous, corrupted and poor country in the region. All this in just two decades in a country where oil was as abundant as arepas in the street so imagine you bet the future of your family in a country where in just 20 years the currency went from 1 US Dollar = 564.5 Bs to 1 US Dollar = 184,058,800,000,000 Bs (probably when you read this it's already an old number and it's worst now).

These are probably the best examples of why it's dangerous to bet in just one country, some countries haven't faced this and I hope they never will but I'm not the one who is going to risk my family's future.

We're lucky, we were born in Venezuela and we know how bad a country could go... It means we learned we can't blindly believe in a country.

The investment approach

If you're from Latin America it's probably you have heard that investors baaad and the "pueblo" goood... Nothing more useless than that in our goal, investing is the way to go and you will see why. My strategy is not something I invented and is not even something new, it's just a well kept secret that only the elite, the 1%, the illuminati, the lizard people, those who rules everything you think and every you do could ever known... You know where I'm going with this right? If not then no problem, sometimes I just like to say stuff without mayor reasons.

Straight to the point

The idea with the investment approach is that we invest some money and this money grows enough so our children will have a pension to live from when they are old and they will never need to worry about it. This is possible to achieve in multiple ways but I mention the easiest one and also my way to do it.

But before explain it, we need to understand how is this possible. The magic in this strategy is the compound interest and the time, you will see that a little amount of money can grow into millions if is compounded enough time.

"Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it".

Albert Einstein

The easy method: One index, one investment.

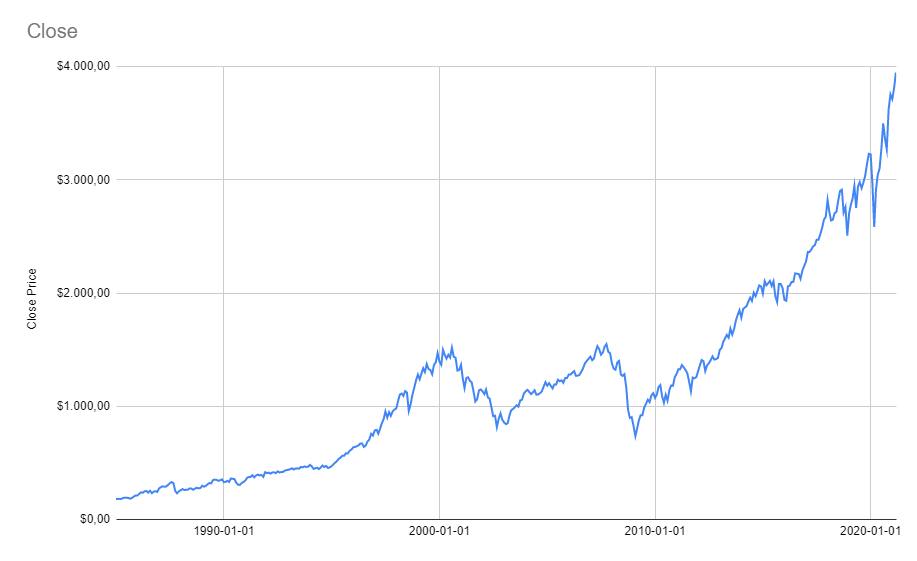

The easiest method is investing in the stock market through ETFs, these ETFs need to target indexes and of course those indexes needs to be from good economies. Let's take the S&P500, one of the most famous indexes in the world which tracks the most important companies in the biggest market today (the US market). This index has growth on average 7% per year since it was created (it includes "inflation", more on this later) so we will take this number as a base for our examples... BUT we always need to remember that nothing in the life is secure and that 7% could be different in the future (and that's why I have my strategy, I will tech you that too).

Some experts say that only USD$ 6,500 are needed for your children but because I'm not that optimist I will take a bigger amount: USD$ 10,000.

If we invest USD$ 10,000 in the S&P500 (to be honest it could be everywhere you can reach a 7% annualized in the long term) when they born and we wait 65 years your child will have USD$ 812,728.61 for its retirement which I believe is enough to live... Magic.

And don't believe me, believe the numbers. Here is a chart of how the price of this index has increased over the years.

So, in theory the only thing you need to do to secure your kid's pension is investing USD$ 10,000 the same day comes to this world and you will be happy because when your child is 65 years old he will have enough money to spend... To good to be true? Well kind of and it's because All that glitters is not gold so let's talk about the main issue we could face with this One index, one investment strategy.

Single point of failure

We know that this index tracks 500 companies so we are diversified right? well... not that much. See, if we only invest in this index we are betting that the US market will continue growing every year during the next 65 years at the same rate. If we only bet in one country's market... isn't that the same of hoping our government will take care of us? Some people will say it's similar, it's up to you.

Also, if we only invest in one kind of asset (an ETF in this case), it means we are exposed to only one kind of asset which isn't recommended either... And to be honest, this strategy relies to much in the S&P500 which is not a good approach in my opinion BUT it helps us understand why investing in the right market and waiting is so profitable (at least big names like Warren Buffet recommend people to just buy the S&P 500).

The active approach: Continuous investment.

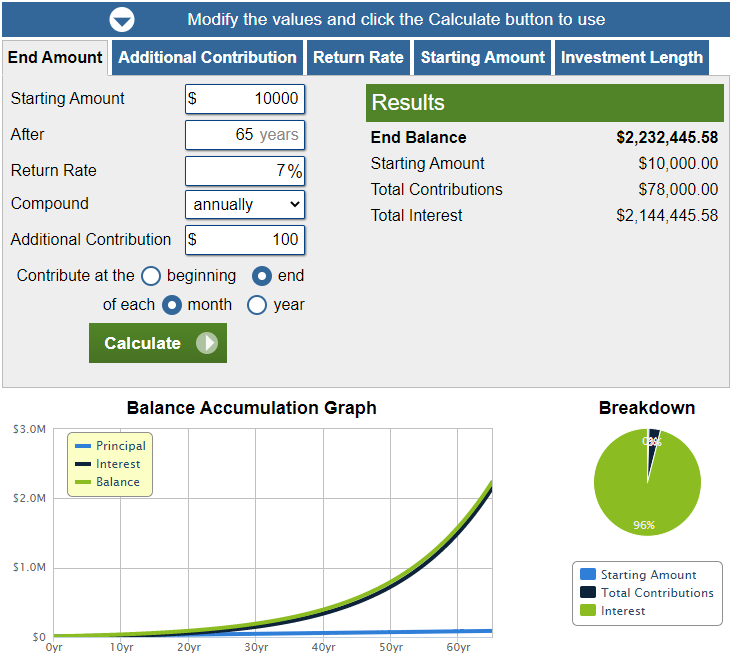

The main idea with all these strategies is to get at least 7% BUT why should we only invest once in those 65 years? What if we invest more money each month? The answer is that the money will grow a lot more... Let's see some examples:

- USD$ 10,000 to start and USD$ 25 every month: Our kid's fund will grow up to USD$ 1,167,657.85 at the end of 65 years. Just because we invested USD$ 25 more every month the fund increased 30% more.

- USD$ 10,000 to start and USD$ 100 every month: The fund will be USD$ 2,232,445.58 in 65 years, more than double of the money your kids will have if you don't invest more money.

Don't believe me? Check this picture:

The family's fund.

But... why only thinking about our children? why not building a whole family's fund? Well, that's my goal. Maybe we don't have enough money and probably we won't be able to enjoy the profits from this fund, but if we follow this plan and we keep constantly adding money to this fund we can build wealth and our next generations will have a fund from where they can get money to live, they will have more opportunities and will have an easier life just because we decide to start it...

Don't know about you but to me that's a pleasure, it's a pleasure to know that we can change our grandchildren's life and they will have a tool we didn't have. One think to have in mind is that we also need to secure this funds so no one in our family could ever waste it and I will talk about it later in another post, how to secure it, how to avoid inherit taxes, etc... It's a big subject and there is a lot knowledge we can get out there.

Of course, this is not a fast way to get rich... but it's the easiest way and it's the method millionaires have been using for decades. Take care.